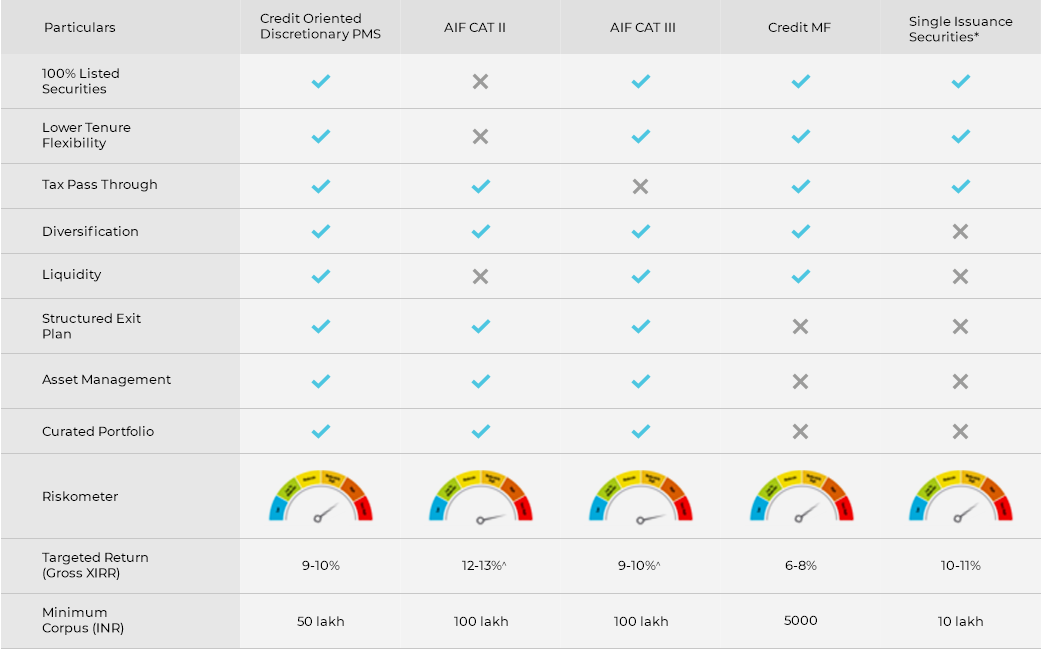

Why PMS over AIF/Credit MF/Single Issuance Securities

A PMS product offered by Northern Arc provides an investor with not only a curated set of investments with the benefit of diversification, exit options and risk adjusted returns but also allows investors to leverage on Northern Arc’s asset management, insight on portfolio companies and monitoring

This communication does not constitute nor form part of and should not be construed as an offer, an invitation to offer, an advertisement or any other solicitation, an advice or recommendation to purchase or subscribe any securities or interests, including any potential interest in any offering by Northern Arc Investments. As per SEBI’s circular dated February 06, 2020, all AIFs are required to showcase their performance against AIF performance benchmarks released by CRISIL. To access the full contents of the SEBI benchmarking report, kindly visit the URL: https://bit.ly/38ptZMl